Section 80: How to save tax in a compliant manner

Taxes are a reality of life and in that respect Section 80 is your best friend to legally cut down on your taxes. The rebates under section 80 are not only a means of saving money, but a way to channel your investment and expenses in a responsible manner which benefits you and the society.

Save Tax Section 80D Table of Content

- What is Section 80 of income tax?

- What is section 80C and what is the maximum rebate I can get?

- Benefits of section 80D? Rebate not only for insurance premiums but much more

- Section 80E – Interest on Education Loan

- Section 80EEA – Interest on Home Loan for First-Time Home Owners

- Section 80TT– Rebates on savings account interest

What is Section 80 of income tax?

Section 80 is a provision under the Income Tax Act which allows individuals to reduce their taxable income by making investments in select investment products or incurring eligible expenses. The government allows these deductions as the savings and expenses under this section are believed to benefit the society and the state in the long term. These tax breaks are listed under various sub-sections from 80C to 80 U under.

What is section 80C and what is maximum rebate I can get?

Section 80C lists out long term investments that the government wants the citizens to make for a secure future. While almost all the instruments are related to asset building (FD , MF, Insurance, Housing etc) this section also gives rebate on expenses towards payment of school fee of children, clearly signifying that investment in education of a child is a long term asset creation.

Section Investment or expenses allowed under the section Maximum Rebate allowed 80C Against expenses like tuition fees of children, repayment of home loan principal, etc. and investments like ELSS, PPF, NSC, etc. Rs. 1,50,000 80CCD (1) Individual contribution for National Pension System Account. Rs. 50,000 80CCD (2) Employer’s contribution towards employees National Pension System Account Upto 14% of Basic + DA ( subject to max of 7.5 lac) 80CCF For investments in Infrastructure bonds Rs. 20,000 A lot of people believe that the maximum rebate allowed under section 80C is Rs 1.5 lac. However, as the table above shows that is not the case. If a person maximizes all the investments under this section, the limit is 2.2 lac + 10% of basic + DA (subject to max of 7.5 lac)

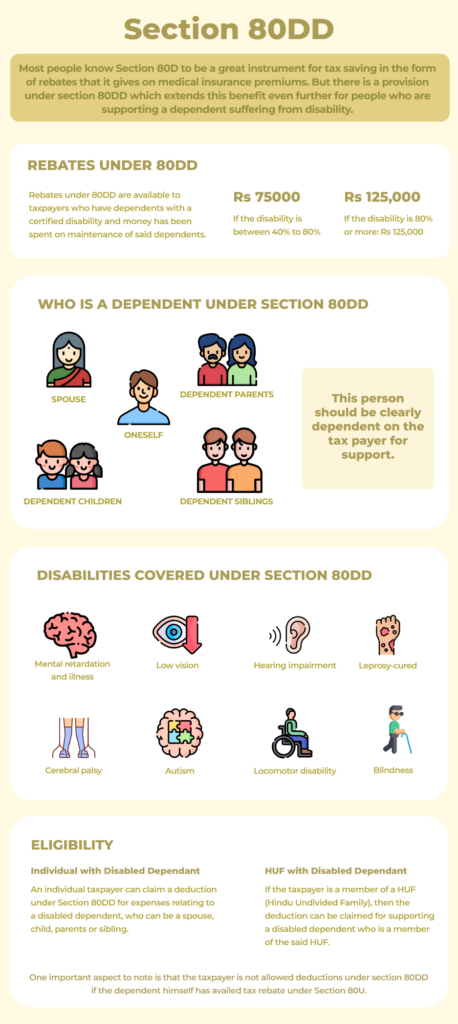

80DD Benefits of section 80D? Rebate not only for insurance premiums but much more

Section 80 D gives tax rebates for insurance purchased for self, family and also parents. The amount of rebate that you can get depends on your age and your parents’ age and can be looked up in the table below

Beneficiaries Deduction for

self & familyDeduction for parents Preventive Health check-up Maximum Rebate allowed Self & Family

(below 60 years)25,000 – 5,000 25,000 Self & Family + Parents

(all of them below 60 years)25,000 25,000 5,000 50,000 Self & Family (below 60 years)

+ Parents (above 60 years)25,000 50,000 5,000 75,000 Self & Family + Parents

(above 60 years)50,000 50,000 5,000 1,00,000 One of the most common myths is that 80D is related only to health insurance premiums, but it offers a lot more. There are two sections of 80DD and 80 DDB which allow the expenses made by an individual to support their dependents suffering from disability and diseases. The definition of dependent and which disabilities and diseases qualify is also clearly listed out by the government.

Section Investment or expenses allowed under the section Maximum Rebate allowed 80DD Against expenses incurred for taking care of disabled dependent relative Rs. 1,25,000 80DDB On expenses made for specific diseases Rs. 1,00,000 Section 80E – Interest on Education Loan

Under section 80E an individual claim tax rebate on interest that they are paying on a loan taken by self, spouse, children or a student for whom the tax payer is a legal guardian. There are two important aspects to Section 80E

- Unlike most other subsections under section 80, there is no absolute upper cap on the interest that a person can claim.

- 80E rebates can be claimed only up to a period of 8 years from start date of loan payment or till the time the entire interest is paid, whichever is earlier.

Section 80EEA – Interest on Home Loan for First-Time Home Owners

Interest paid on home loan, up to 2 lac is exempted under section 24 of income tax. Over and above Section 80EEA provides taxpayers with an extra deduction of 1.5 lac per financial year for paying interest on a house loan taken between 1st April 2019 to 31st March 2022.

Section 80EEB – Interest paid on Electric Vehicle Loan

To encourage the purchase and usage of electric vehicles, deduction is allowed for interest paid on vehicle loan availed to purchase the electric vehicles up to Rs.150,000.

Section 80 G

Donations made to charitable funds is eligible for income tax rebate under section 80G. Under section 80G there are categories of funds that give varying levels of exemption.

Section 80TT– Rebates on savings account interest

Allows rebate on interest earned on Savings Accounts. There are two subsections 80TTA and 80TTB

- Section 80TTA deduction can be claimed by an individual or HUF. Maximum deduction allowed under section 80TTA is Rs 10,000.

- Section 80TTB deduction can be claimed by a resident senior citizen aged 60 years and above at any time during the financial year. Maximum deduction allowed under section 80TTB is Rs 50,000.

Section 80 U

Under section 80 U

For a person suffering from physical disability Section 80U allows a rebate of up to Rs 125,000 annually for severe disability. For purpose of rebates under section 80U following disabilities are considered

- Blindness

- Low vision

- Leprosy-cured

- Hearing impairment

- Loco motor disability

- Mental retardation

- Mental illness

As Benjamin Franklin once remarked that one could be certain of only two things in this world, Death and Taxes. And while we are not the ones to quibble with the wisdom source that Ben Franklin was, we believe section 80 has enough for an aware person to considerably reduce their tax burden and also contribute to their own secure future, and a more compassionate society.

Conclusion

Secure is designed to provide you and your family with comprehensive, accessible, and affordable healthcare solutions. Whether you’re an individual, a family, or a senior citizen, there’s a plan designed to provide financial security and peace of mind.

Some key reasons why you should choose CarePal Secure are:

Extensive Coverage: Get access to a wide network of hospitals for cashless treatments, covering everything from regular health check-ups to major hospitalisations.

No Waiting Period for Essential Coverage: CarePal Secure offers immediate access to essential healthcare benefits so that yCarePal ou can receive critical medical treatment without long approval delays.

24/7 Medical Assistance & Claims Support: Our dedicated helpdesk is available round-the-clock to assist you with medical emergencies, claim processing, and consultation bookings.

Teleconsultations & Healthcare Discounts: Our seamless teleconsultation services allow you to access specialists across 18+ medical fields. Additionally, you can enjoy significant savings on medicines, diagnostic tests, and outpatient care, making quality healthcare more affordable.

Affordable Plans with Super Top-Up Options: Choose from a range of budget-friendly plans for individuals, families, and seniors. Our super top-up policy for seniors provides additional financial protection, covering larger medical expenses at a lower cost.

Tax Benefits Under Section 80D: The premiums paid toward CarePal Secure health insurance are tax-deductible, helping you save money while ensuring comprehensive coverage for yourself and your family.

With trusted partners nationwide, CarePal Secure ensures that quality healthcare is always within reach. So what are you waiting for? Join 80,000+ satisfied customers who trust CarePal Secure for their healthcare needs.

Get in touch with us to know the right plan for you.